Everytime you file your personal earnings taxes, a predominant a part of your kind will potential be devoted to declaring the earnings you earn. This can be as simple as merely checking the decide in your EA kind and filling it in. Nonetheless when elements like extra allowances and benefits come into play, it’d sound somewhat little bit of additional strong.

What counts as “earnings from employment?”

Statutory earnings from employment refers to not solely your month-to-month wage, however moreover any price, bonus, allowances, perquisites, benefits-in-kind, and even lodging. In exact reality, there are express sorts of earnings inside this itemizing that does not have to be included in your earnings for tax capabilities – in numerous phrases, earnings that is exempted from tax. Throughout the event you might be given a tax exemption as quite so much as a optimistic worth, you don’t have to include that amount in your declaration of earnings.

Perquisites, benefits-in-kind, and tax exemptions

A perquisite is a perk or revenue given to you by your employer, like journey and medical allowances. Benefits-in-kind are moreover a type of revenue obtained by employees which are not included of their wage, very like cars, furnishings, and personal drivers. It doesn’t matter what they’re commonly known as, it is a should to protect observe of the additional benefits given to you as a consequence of they might each be taxable or tax exempt. That may be a checklist of perquisites and benefits-in-kind which you will exclude out of your employment earnings.

Perquisite/Revenue-in-kind

Tax Exemption Limit (per 12 months) Petrol, journey, toll allowances As quite so much as RM6,000. If the amount exceeds RM6,000, extra deductions might be made in respect of amount spent for official duties. Parking allowance, along with parking price paid by employer instantly Precise amount expended Meal allowance obtained repeatedly Precise amount expended Medical benefits (along with typical treatment and maternity funds) Precise amount expended Teen care allowance for youngsters as quite so much as 12 years outdated As quite so much as RM2,400. Revenue, whether or not or not or not or not in money or in one other case, for earlier achievements, service excellence, or prolonged service award, and so forth As quite so much as RM2,000. Current of mounted line cellphone, mobile phone, and so forth registered in employee’s resolve Restricted to 1 unit for each asset Month-to-month funds for cellphone or broadband line registered in employee’s resolve Restricted to 1 line for each class of asset Firm objects outfitted free or at a discount to employee, companion, or single kids As quite so much as RM1,000 Firm objects outfitted free or at a discount to employee, companion, or single kids Amount of low price or amount of corporations outfitted free Subsidised curiosity for housing, coaching, or car mortgage Absolutely exempted if complete mortgage amount would not exceed RM300,000. For exceeding elements, there is a calculation elements that you’ll uncover all by means of most of the people ruling for this allowance. Depart passage (journey time paid for by employer) Exempted as quite so much as 3x in a 12 months for go away passage inside Malaysia (fares, meals, lodging) and 1x outside Malaysia (as quite so much as RM3,000 for fares solely)

*These tax exemptions aren’t related for directors of managed firms, sole proprietors, and partnerships.

What happens whether or not it’s good to declare a benefit-in-kind as part of your employment earnings? You presumably can’t exactly put down “one car and one driver” in your kind as part of your earnings, so that you just merely’ll should prescribe it a monetary worth with a goal to be taxed. This can be completed by the climate methodology or the prescribed methodology. Ought to it is best to know extra about these methods of calculation, PwC affords a superb clarification in its Malaysian Tax Booklet.

Fully completely completely different tax exemptions and sources of earnings

You could be required to pay taxes in your earnings arising from any lease obtained, nevertheless there is a 50% tax exemption on this class for Malaysian resident individuals. The exemption is proscribed to RM2,000 per thirty days for each residential dwelling rented out, and the residential dwelling have to be rented beneath a licensed tenancy settlement. Moreover, the exemption is given for a most of three consecutive years.

Curiosity earned from the subsequent institutions are tax exempt: licensed banks, Islamic banks, or finance firms, developed financial institutions, Lembaga Tabung Haji, the Malaysia Rising Society Berhad (MBSB), and the Borneo Housing Finance Berhad. Dividends obtained from exempt accounts of firms, cooperative societies, and accredited unit trusts are moreover exempt from tax.

Ladies getting back from the workforce are eligible for earnings tax exemption beneath TalentCorp’s Occupation Comeback Programme all through the occasion that they’d been away from the workforce for in any case two years.

Fully completely completely different tax exemptions chances are high you will income from are:

- Compensation for lack of employment

- Lack of life gratuities

- Earnings derived from evaluation findings (50% exemption)

- Pensions after the age of retirement or ailing correctly being

- Retirement gratuity after the compulsory age of retirement after 10 years of regular service or ailing correctly being

- Scholarships

Don’t overpay your taxes

Malaysia operates on a self-assessment system by way of earnings tax, so the taxpayer is accountable for calculating their very personal chargeable earnings and payable tax. That’s why you wish to think about which parts of your earnings is taxable or exempt. Hopefully, this textual content material materials has helped highlight some tax exemptions you weren’t acutely aware of earlier than so chances are you’ll file your taxes extra exactly.

When it is best to have any questions, do inform us all by means of the suggestions!

Additional on Malaysia earnings tax 2019

- Malaysia Earnings Tax: An A-Z Glossary

- How To File Your Taxes For The First Time

- How To Maximise Your Earnings Tax Refund Malaysia 2022 (YA2021)

- Earnings Tax Malaysia: Quick Data To Tax Deductions For Donations & Presents

- Malaysia Non-public Earnings Tax Data Malaysia 2022 (YA2021)

Uncover extra earnings tax related content material materials supplies provides in our Earnings Tax net web net web page.

3.2 5 votes Article Rating

SHARE

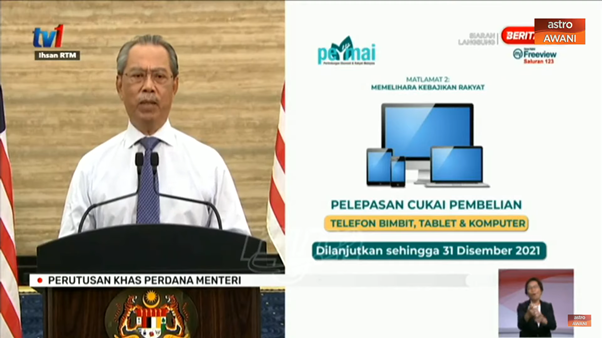

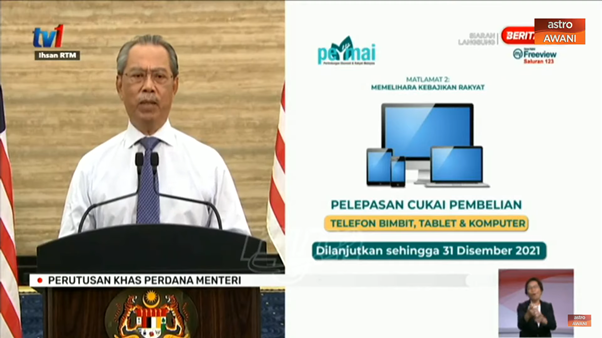

(Image: Bernama)

(Image: Bernama)  (Image: Bernama)

(Image: Bernama)

(Image: New Straits Circumstances)

(Image: New Straits Circumstances)

(Image: Focus Malaysia)

(Image: Focus Malaysia)  (Image: The Star/Muhamad Shahril Rosli)

(Image: The Star/Muhamad Shahril Rosli)