How To File Your Taxes For The First Time

They’re saying that in life, you presumably can’t run away from two factors: dying and taxes. In Malaysia, earnings tax is obligatory by regulation, and the earnings tax you pay differ based mostly in your full taxable earnings for the 12 months. Do it’s a must to’ve merely entered the workforce, and have absolutely no thought how all this works, correct proper right here’s a useful data on how one can file your taxes for the primary time.

Ahead of we start, it is best to first resolve for many who’re eligible as a taxpayer. Based totally on the Inland Income Board (IRB) of Malaysia, moreover often called Lembaga Hasil Dalam Negeri or LHDN, a Malaysian particular explicit particular person should register a tax file throughout the event that they earn an annual employment earnings of RM34,000 (after EPF deduction).

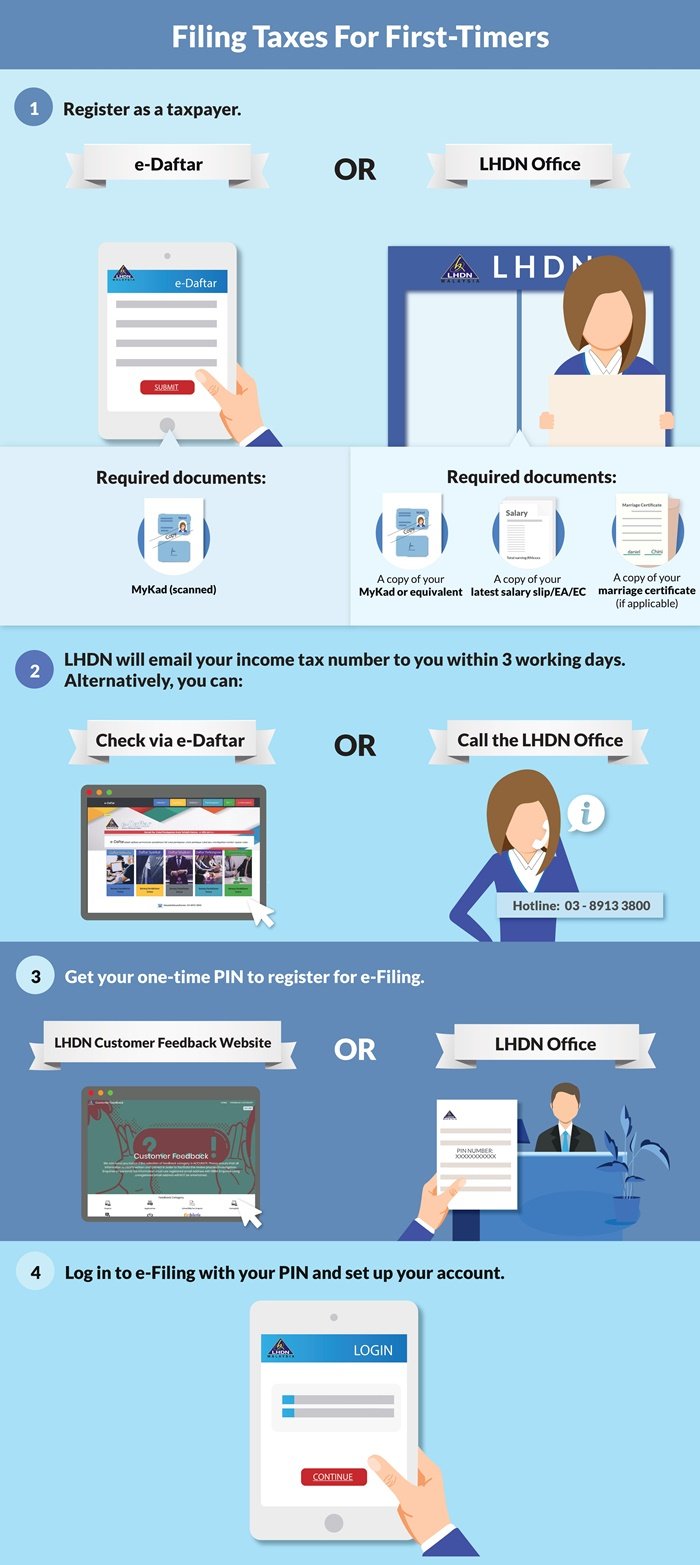

In case your annual employment earnings is above that resolve, it might be greatest to do two factors: register your self as a taxpayer to LHDN, after which register for e-Submitting, which is LHDN’s on-line earnings tax submitting platform. Take a look at the steps it is best to take when registering for earnings tax in Malaysia for the primary time – considerably now that the LHDN has made it potential as a strategy to full your full registration course of on-line.

1. Use e-Daftar and register as a taxpayer on-line

To kickstart the tactic of registering as a taxpayer, head on over to the LHDN’s e-Daftar web site on-line, the place you presumably can conveniently perform the tactic on-line. You’ll have in order so as to add a digital copy of your IC to function supporting doc, so it might be an excellent suggestion to rearrange that beforehand.

Truly, you presumably can nonetheless resolve to go to the LHDN workplace to register for many who happen to want, nonetheless the board has immediate most people to conduct their firms on-line wherever potential in light of the present Covid-19 pandemic. If you need to go to the LHDN areas of labor although, keep in mind to take a look at their working hours and if the division that you just merely’re headed to is presently open. Furthermore, assure to convey alongside a copy of your IC and the newest wage slip or EA type for the tactic.

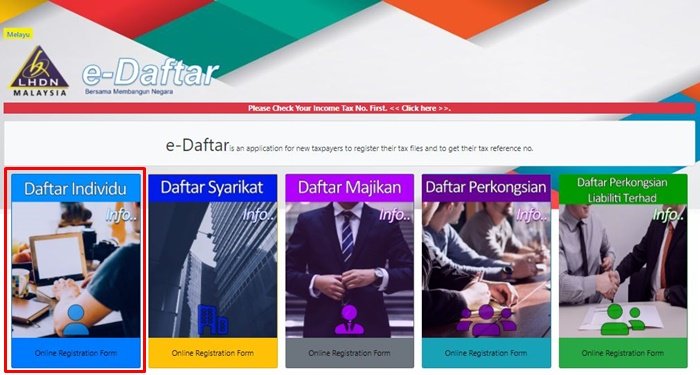

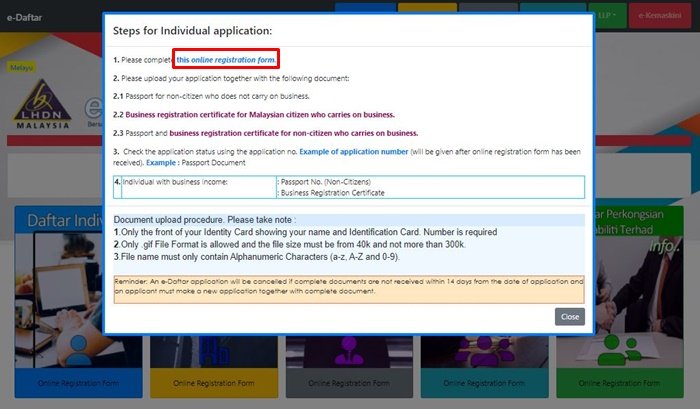

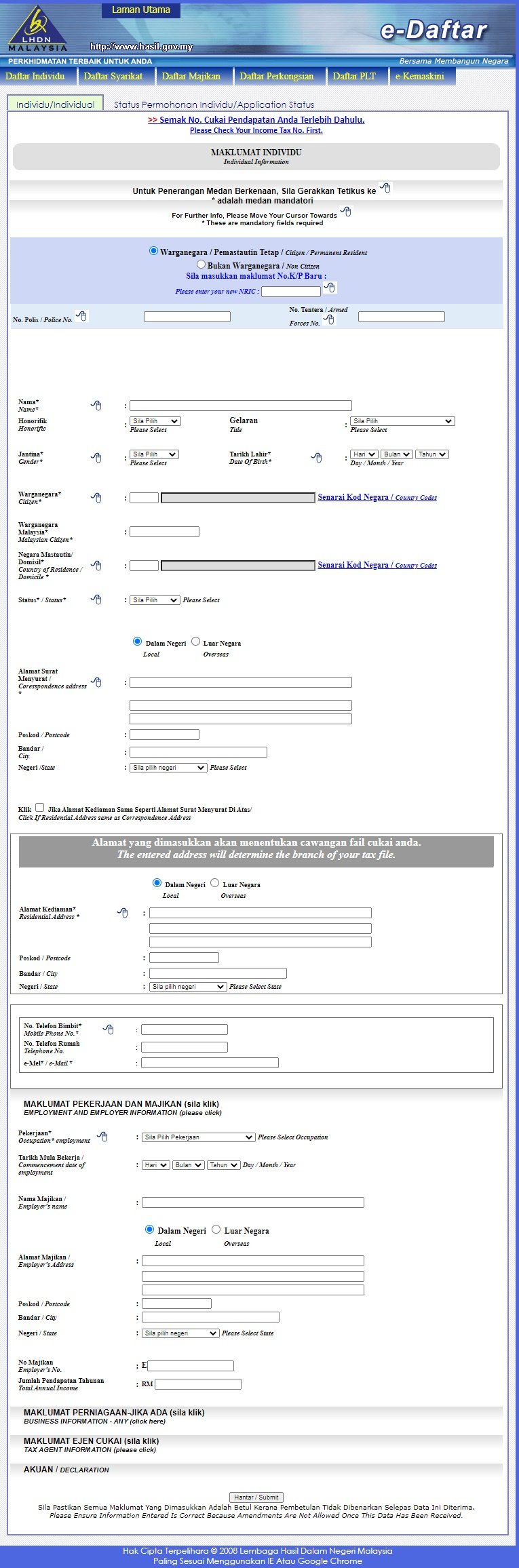

Do it’s a must to’re doing all your registration on-line by way of e-Daftar, then go forward and click on on on on “Daftar Individu” on the web web site, adopted by “this on-line registration type”. It’ll then lead you to the shape, which is sort of in depth on account of it requires all the compulsory particulars about your self alongside along with your present employer.

Upon submitting your type, you’ll then be assigned an utility quantity. That you must use this quantity to regulate to up in your utility or to submit the required supporting paperwork (for many who happen to didn’t cope with to take movement whereas filling up the shape). Simply so that you acknowledge, you presumably can nonetheless add supporting paperwork on-line (by way of the LHDN Purchaser Choices web site on-line) or fax them to the LHDN inside 14 out of your date of e-Daftar registration.

From there, it might be greatest to attend for about three days on account of the LHDN processes and approves your utility. As rapidly as authorised, you’ll purchase an e-mail containing your earnings tax quantity. Alternatively, you presumably can take a look at by way of e-Daftar or give the LHDN a popularity.

e-Daftar may even be accessible by means of MyTax – a mannequin new service portal that was launched by the LHDN in order that taxpayers can conveniently entry their newest data with out having to go to the board’s workplace.

2. Get a PIN for e-Submitting registration

Now that you just merely’re registered as a taxpayer alongside along with your explicit particular person tax file, it’s time to register for e-Submitting on the ezHASiL platform! The registration for e-Submitting is crucial due to that is the place you’ll file your returns on-line as an official taxpayer.

To register or log in to your e-Submitting for the primary time, you’ll be in want of a PIN – which have to be geared up by the LHDN. To build up this, you presumably can select to every stroll in to the closest LHDN workplace, or apply for it by way of the LHDN Purchaser Choices web site on-line.

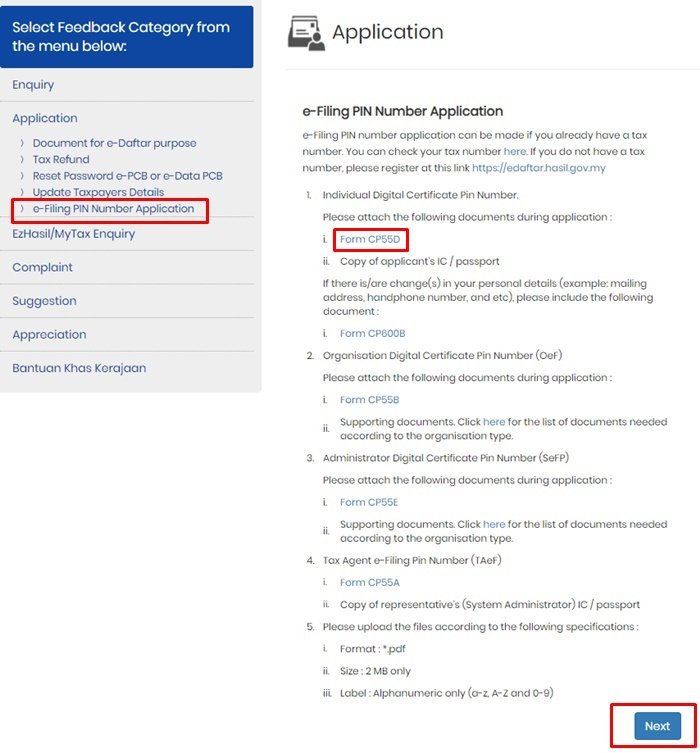

Do it’s a must to’re making use of in your PIN by way of the LHDN Purchaser Choices web site on-line, listed under are the few steps that you just merely’ll have to take:

- Click on on on on “Utility”, adopted by “e-Submitting PIN Quantity Utility” contained in the left menu.

- Click on on on on “Type CP55D” and fill contained in the PDF type.

- Click on on on on “Subsequent” to submit your utility.

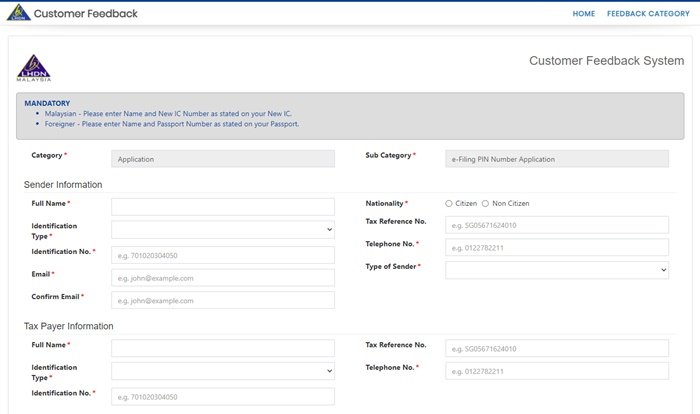

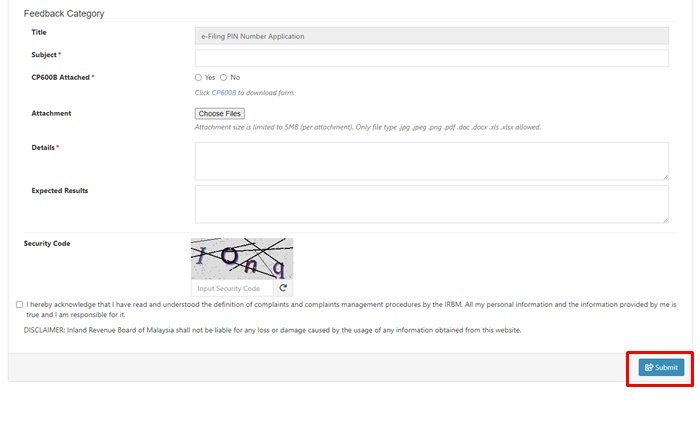

- Fill contained in the required data, and don’t overlook in order so as to add the complete required paperwork (considerably Type CP55D and a digital copy of your IC).

- Submit!

Similar to on e-Daftar, you’ll furthermore purchase an utility quantity this time spherical, which it’s best to make use of to regulate to up in your utility if essential. In another case, it is best to accumulate your PIN inside seven working days.

After getting the PIN, head on to the e-Submitting web site on-line and click on on on on “First Time Login”.

3. Login to e-Submitting and full first-time login

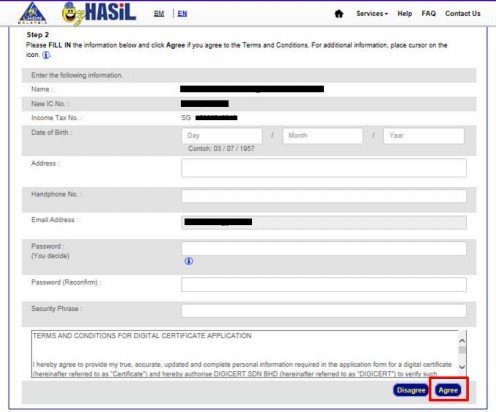

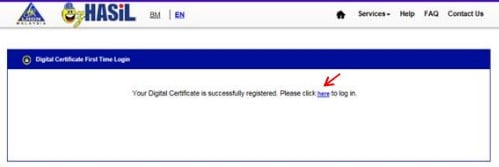

There’ll be a textual content material materials space to enter your PIN quantity (which you merely obtained) and IC quantity, and upon clicking on “Submit”, you’ll be directed to a singular type. Correct proper right here, fill in your particulars, equal to your date of beginning, cope with, cellphone quantity, and likewise a password for future logins. You’ll furthermore should confirm that your title, IC quantity, and earnings tax quantity listed contained in the system is appropriate, and click on on on “Agree”.

Observe that you will need to set and keep in mind your password correct proper right here, so to log in to e-Submitting later. The PIN quantity is a single-use code solely, and is supposed for first-time logins – subsequent logins would require a password that shoppers set.

Uncover furthermore that you will be required to key in a safety phrase. You presumably can protect this empty for now – the system will quick you with clearer directions later.

4. Login to e-Submitting as quickly as additional

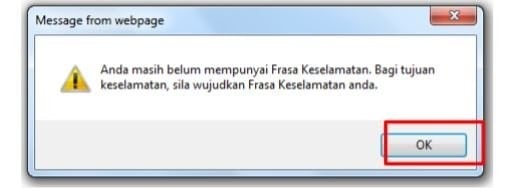

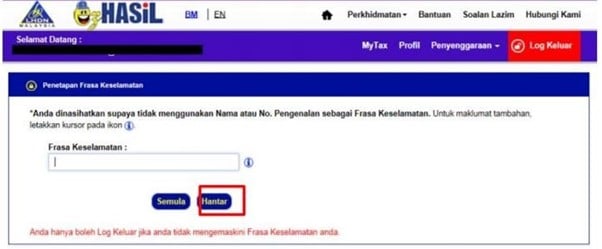

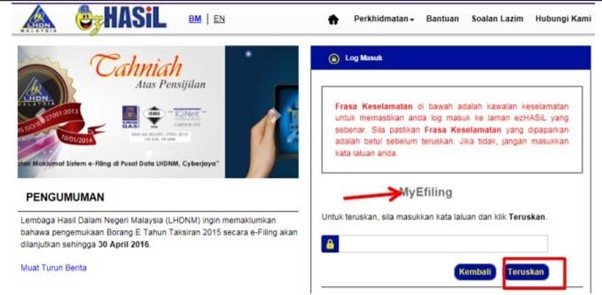

When you full the steps above, it is best to log in as quickly as additional to e-Submitting and arrange a safety phrase. That is normally a secondary layer of safety, designed to stop unauthorised entry. Like before, log in alongside alongside along with your IC quantity, and instead of your PIN, use your freshly-created password. A pop-up message will inform you that you haven’t nevertheless arrange your safety phrase.

This phrase will seem the subsequent time you log in after you key in your IC quantity. That is very like on-line banking web pages that present a safety phrase and/or a picture that the actual particular person beforehand chosen. For e-Submitting, the safety phrase ought to stick to the next suggestions:

- Between 8-15 characters

- Alphanumeric characters solely; no symbols or particular characters are permitted

Along with, shoppers are immediate to not use their title or IC quantity as their safety phrase.

This generally is a essential safety layer, so the e-Submitting platform won’t assist you to log out or proceed till you will have arrange your safety phrase. As rapidly as that’s sorted out, proceed to log out and log in as quickly as additional – you’ll have the ability to see your safety phrase now.

5. File your taxes

Congratulations! You’ve successfully registered as a taxpayer, created an account for e-Submitting, and accomplished the first-time login procedures. Now, it’s time to file your taxes, and (hopefully) get a tax refund! We’ll be serving to you all the way in which wherein whereby with a step-by-step data for submitting your earnings tax in Malaysia 2022 (YA 2021), so protect tuned! Uncover further earnings tax associated content material materials supplies in our Revenue Tax web net web page.

4.8 35 votes Article Ranking

SHARE