How To Try If Your Resort Protect Is Eligible For The Tourism Tax Low value

All through the occasion you had booked a lodge or visited a vacationer attraction in Malaysia all by means of 2021, you might be eligible for an earnings tax assist of as quite lots as RM1,000 on the funds. As you may presumably recall, the exact tourism tax assist that was launched beneath the Monetary Stimulus Bundle 2020 – initially for March to August 2020 – had been extended up until December 2021 (and as shortly as extra until end of 2022).

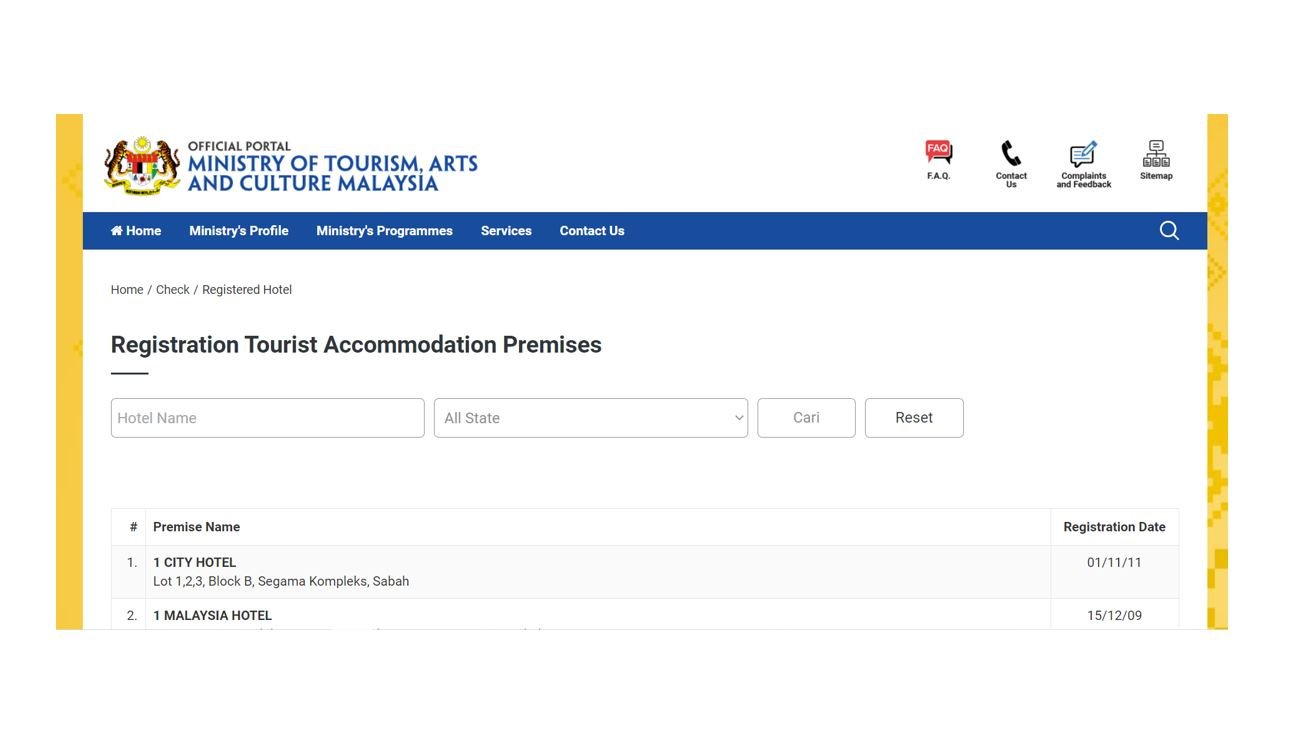

To qualify for the tax assist, your protect needs to be at one among many lodging premises that is formally registered with the Commissioner of Tourism Malaysia. You might merely affirm this on the Ministry of Tourism, Arts and Personalized Malaysia site, which has a searchable report of registered vacationer lodging premises. There are a whole of 4,735 lodging premises registered as of the time of writing.

This tax assist applies on funds made between 1 March 2020 and 31 December 2021 as quite lots as the amount expended, restricted at RM1,000 for the analysis yr. As is widespread with tax assist claims, it will be finest to take care of the associated receipts and supporting paperwork for seven years, because of it is possibly requested by LHDN as proof.

This tourism-related tax assistance is one amongst a great deal of new tax measures launched to help stimulate the financial system along with lighten the burden of Malaysians all by means of the Covid-19 panorama.

3.6 10 votes Article Rating

SHARE